Did you know you can secure a delinquent property before auction? This means you’re buying from the current owner without taking you through the entire registration and bidding process. It could have been the case if the government repossessed the property. The idea is impressive but requires as much keenness as all delinquent sales and purchases.

Below are tips for a successful and rewarding investment in tax-sale properties.

Why Sell Their Property Before It’s Auctioned?

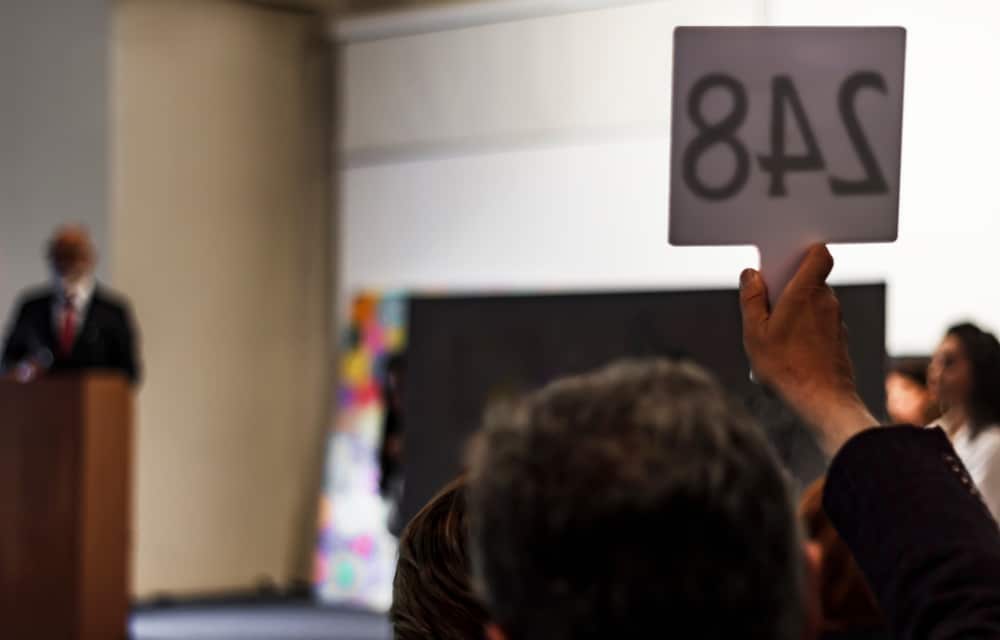

First, consider some reasons that may prompt homeowners to sell their tax-due properties rather than give them to the government. Many prefer this channel because it yields some profit, which they may lose if the government takes over. Furthermore, they will be in more control of how much they can offer for possession, unlike when it’s all about the highest bidder.

Giving up your property for auction may negatively impact your credit score. That means your financial life may be at a considerable stage after that and for quite some time before stabilizing again. Generally, it can be devastating to watch your beloved belongings go into auction, so selling them yourself relieves the frustrations.

Benefits of Buying a Delinquent Property

One of the most compelling advantages for obtaining tax delinquent properties this way is affordability. Engaging directly with the homeowner can lead to more affordable investment opportunities. Your chances of negotiating are stronger at this stage than during auction bidding. Sellers are often motivated to complete transactions quickly to avoid auctions, providing you with an upper hand.

Purchasing a property with overdue taxes can be advantageous for reinvestment purposes. Buyers face fewer restrictions on how and when to alter the property for resale. This contrasts with auctions, where you might have to wait for various formalities to conclude before you can rent, resell, or renovate.

There’s also less risk involved when buying from the homeowner directly before an auction event. You’ll have access to comprehensive details about the property, including the opportunity to view it before committing to a deal. Tax sales generally provide limited information and might require hiring a real estate agent.

Furthermore, direct purchase saves time and avoids bidding wars. You can take ownership of the property immediately and begin remodeling according to your plans without delay.

Research More About the Property

Your due diligence when dealing with delinquent properties influences investment success. You must dig deeper to determine if the idea is worth your hard-earned pennies. Some of the information includes the product’s current condition in terms of deterioration and functionality.

That means physical inspection is required. You must also look at the performance of such sale procedures on the immediate market. Other information to find out is the current buyer, their history with property sales, and the number of outstanding liens.

You can find all this information from online searches, property tax databases, government auction listings, public records, and most importantly, from the professionals.

Engage a Professional

Yes, real estate professionals can offer information and guidance regarding delinquent properties. The process of buying a tax-due property can be too delicate to navigate on your own.

Experts like real estate agents/brokers, financial advisors, real estate attorneys, and home inspectors can help with the process. Others are contractors, lenders, accountants, appraisers, and title companies.

Budget for the Investment

Unguided investors can easily be persuaded by the benefits of buying a delinquent property before auction. The buyer may also want to get rid of the property soon. Some need to budget for the investment and fall into financial frustrations.

Like any other product, this one requires evaluation and budgeting. Develop a reasonable plan incorporating the buying price, repair costs, administrative, tax, recording, attorney, title search fees, and other costs.

Get in Touch with the Owner Directly

As highlighted earlier, tax-due properties are better than standard ones. Therefore, buying one before it is auctioned is safer if you deal with the owner directly rather than a broker or exclusively through calls, emails, and other non-physical means. It’s a red flag when the seller doesn’t prefer physical meetings or is inconsistent with communication.

With this blog and some effort, you can enjoy all the benefits of investing in delinquent properties before auctioning them. Adhere to all the tips above and watch yourself walk out with one of the most valuable investments of your life. If you want to take this path today, consult a reputable real estate company and let them guide you.